Our Master’s program in Financial Engineering offers you a unique combination of finance theory, engineering methods, management tools, mathematical and computational techniques – blended with new developments from the field of artificial intelligence and data science. Financial Engineering introduces you to these techniques in a practical way, with a focus on hands on applications implemented in the Python programming language.

Focus Points of Financial Engineering

- Data science

- Machine learning for business and finance innovations

- Data-driven decision making

- Financial and risk management with python

Key Facts

- Structure: Part-time (but enrolled as a fulltime student)

- Duration: 15 months plus time needed for master's thesis (varies)

- Costs: 36,000.00 € (thirty-six thousand Euro) overall (detailed information on our costs and fees webpage)

- Language: English

- Degree: Master of Science (M.Sc.) of the Karlsruhe Institute of Technology (KIT), 90 ECTS

- Start: Every year in October (flexible schedule possible)

- Application deadline: There is none. We have a rolling application process.

- Admission requirements: First academic degree (e.g. Bachelor, Master or Diploma), at least 2 years professional experience, English language proficiency. Find more here.

- Accreditation: by aaq

Modeling and Understanding Data to Untap Hidden Value

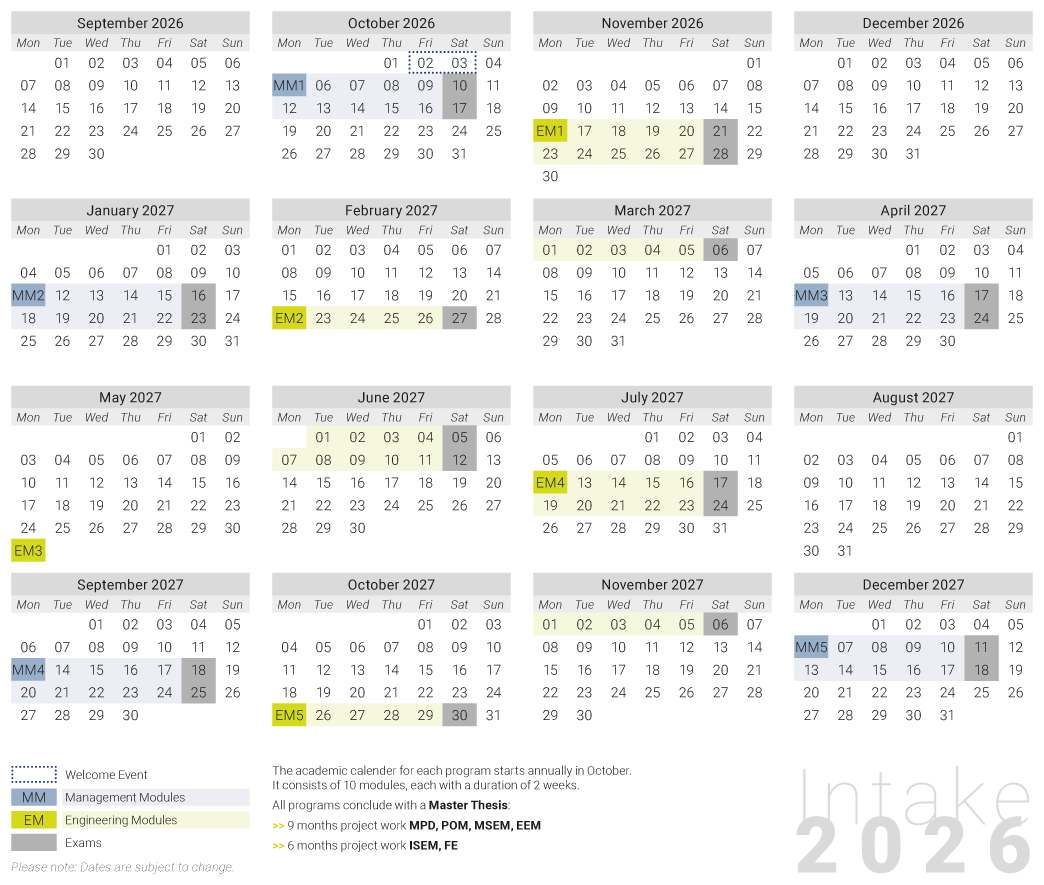

The master's program Financial Engineering is divided into 5 engineering and 5 management modules of 2 weeks each, over a period of 15 months. The modules are followed by a master thesis written in the company (6 months) and often used as an innovation project for the company. The overall duration is approx. 20 months.

| Engineering Modules | Management Modules |

|---|---|

Preparatory Courses*: |

|

Temir Vinokhodov (he/him)

Admissions & Program Consultant

info ∂does-not-exist.hectorschool com

+49 721 608 47880

Program Content

The Master´s program in Financial Engineering provides innovative solutions of pricing, hedging, trading and portfolio management problems by employing advanced mathematical methods and computer technology. Graduates will be qualified to consider challenges in the financial sector from an engineer’s point of view and to develop and optimize innovative solutions on the basis of fundamental economic laws.

Knowing the Right Answer

After completing the Financial Engineering Master program you will have answers to vital questions like:

- Should company X manufacture product Y?

- Should company X build a warehouse in Z?

- How does a delay change the value of the project?

Making Better Decisions

Understanding projects strategically helps to make better decisions:

- Learn which decisions need to be taken in order to leverage the value of the company/product.

- Recognize the strategy behind the project and understand the big picture

- Know what mergers, acquisitions and changes mean and how you can influence the consequences.

- Create compelling evaluation systems and key figures to present your project, your department and yourself the best.

The right decision: With this Master´s program prepares you are prepared for a vibrant future!

Program Structure & Academic Calendar

Program Structure

The concurrently taught Executive Master’s program is designed for working professionals. Block lectures scheduled at intervals allow participants to continue their demanding careers while acquiring new skills.

The Master’s program is divided into 10 modules: 5 Management modules present broader knowledge in management know-how and 5 Engineering modules provide deeper knowledge in technological topics.

Download the Academic Calendar Intake 2026 (PDF)

Content Overview & Learning Targets

Order now our "Content Overview and Learning Targets" (COLT) to get a better understanding of your favored Master Program. You will get an overview over

- Study objectives (e.g. professional qualification for certain activities, scientific practice, knowledge of methods)

- Structure of the program

- Content and definition of courses (sub-areas, focal points)

- Study plan

Click here to request your "Content Overview and Learning Targets" handbook.

Economic Sector & Career Perspective

Participants of Financial Engineering

Participants of Financial Engineering strive for a demanding career in a financial company such as an investment or commercial bank, an exchange or a rating agency. The techniques are also to the utmost benefit for candidates who pursue a career in a non-financial corporate, since the topics covered are well applicable to corporate finance, and corporate risk management.

Professionals working in financial product-oriented service sectors, e.g.:

- Consulting agencies

- Investment and private banks

- Corporate departments in industry

- Insurance companies

Career Perspectives after Graduation

With the pace of financial innovation, the need for highly qualified people trained in financial engineering also increases.

In many areas, the financial industry is currently facing structural changes to its offerings, IT systems and processes. The operational picture is characterized by a high project volume. Due to the high cost and competitive pressure, employees must be able to think and act in a cost-conscious, networked and innovative manner. This increasingly requires an interdisciplinary academic education for managers and future managers with modern IT skills, skills in designing industrial processes up to skills in managing large change programs.

Alumni Voice

"HECTOR School is the school of life. You rise coping with the challenges and each module is the next step of your progress."

Ekaterina N. Sereda/HECTOR School Intake 2007

RWE Supply & Trading

Find more Alumni Voices of our Master´s Programs

Academic Requirements & Admission Statutes

Academic Requirements

- University degree in a relevant subject

- Professional experience (at least 1-2 years) & current employment

- English proficiency

Detailed description of all admission requirements

Admission Statutes

Download the statutes for admission to the Master's program in Financial Engineering (only available in German).

Program Directors & Faculties

Program Directors

|

Prof. Dr. Maxim Ulrich |

|

Prof. Dr. Martin E. Ruckes |

KIT Teaching Quality

The HECTOR School offers top-level teaching derived from state-of-the-art research at the Karlsruhe Institute of Technology (KIT). Numerous institutes and departments of the KIT are involved in the HECTOR School Master´s program Financial Engineering:

- Institute of Decision Theory and Management Science

- Institute of Economic Policy Research

- Institute of Finance, Banking and Insurance

- Institute of Industrial Production

- Institute of Information Law

- Institute of Operations Research

- Institute of Applied Business Studies and Management

- Institute of Applied Informatics and Formal Description Methods

- Institute of Economic Theory and Statistics

- Institute of Financial Engineering and Derivatives

- Institute of Information Systems and Marketing

- Institute of Product Development

- Institute of Statistics and Mathematical Economic Theory

Find out which requirements you need in order to be admitted to our Master's programs.

READ MORE

Certificate of Advanced Studies (CAS) in Future Mobility Topics

LEARN MORE

We assist you in finding the best education program to fit your individual needs and career profile.

READ MORE

Unlocking Career Potential in Systems Engineering, E-Mobility or Automated Driving

Find out more

*Preparatory Courses

Crash Course “Probability and Statistics” - December 15, 2025 - January 15, 2026: Participants without experience in the field of probability are highly recommended to take part in the crash course “Probability and Statistics”. Thanks to the blended learning format you can schedule the courses yourself within these two weeks. You have an exchange with the lecturer during video meetings in order to prepare yourself optimally for the start of your studies.

We highly recommend all applicants to participate in the courses to update the technical knowledge, as it might be a crucial factor for a successful Master degree at HECTOR School.